It’s good to have money and the things that money can buy, but it’s good, too, to check up once in a while and make sure that you haven’t lost the things that money can’t buy.

George Lorimer

Save more money on our daily expenditure and restructure our mind to spend less

Having sufficient amount of money is indeed a success. We usually failed to save money because of our overspending habits. We often spend our money on the things that are either not necessary much or will be useless soon in the future. Do you want to save money on ‘not-so-important’ things? Are you unable to hold yourself from spending more? Do we want to save money on purchased items but not necessarily in the bank? Save more money on our daily expenditure and restructure our mind to spend less

Why saving money is important ?

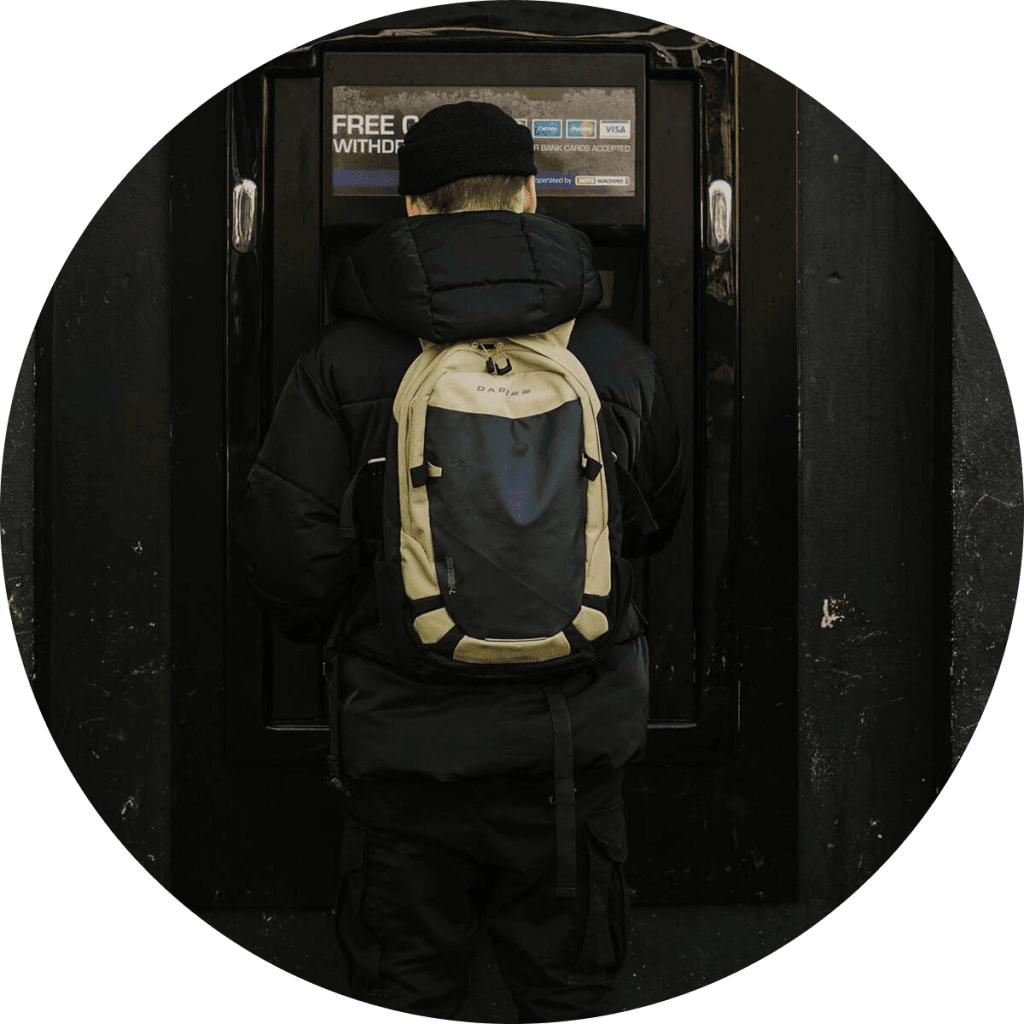

These questions are one of the biggest hidden problems of almost everyone. No matter whether we are a 12-year-old child, or a father of two of the same age, or we withdraw our money from our pension account, we lie in the same line. We find ourselves into the same situation every single day, and it always remains fresh in somewhere in our daily course of life.

Saving money is about securing tomorrow. Having a decent amount of money in our pocket is definitely a life worth living. We can easily have what we wish for. But saving a tiny part of the money we spend, is of course an art.

It requires attention, willpower, consistency, and most importantly understanding of our self-Psychology. The secret is not about what our money is spend for, but about how we do so. Actually, the secret is about what we think while we are spending.

Here are the five tricks we must deliberately have in our mind while spending our money

1. Earn in Dollars, Think of it as in Ponds

Money is a relative phenomenon. And there are hundreds of currencies we can relatively compare it with. We have a tendency of spending less on the things that are quite costly. So, why not to think of it as in some other currency that has higher value than our currency value.

For instance, if we have 500 Dollars so take it as we have 500 Ponds. The point here is that if we consider our 500 dollars as some 500 Ponds, then we start spending less.

Restructuring our mind

It happens because we subconsciously start thinking of products as costly and we begin to spend on products that are seriously important to us. This is also a way to keep our mind active. Suppose if we have to buy a book that is of 10 dollars, and as we consider our money in Ponds, so we will find our 10 Pond book way more costly, and this prevents our mind to spend only on things that are really necessary for us to have. We can choose any higher currency that suits our budget and mindset.

2. Save Money on Product Offers

There are offers on almost every single product in the market, be it cloth, book, eatables, in fact we can even get offers on the services also. We just need to find a right spot. It is in our human psychology that we never want to leave a good quality product in much cheaper price.

The same product, same quantity or quality but we can definitely find offers available on it, only if we just use our phone and search for the same. The trick is that you don’t take it as you have got your product in a cheaper price, just consider it as same value and save that extra penny. At the end of the year, you would realize that you have saved the amount almost equal to your one month’s salary or income.

3. Categorizing the products and its value

We must personally have a habit of categorizing the things into three essential categories that are a) Most Important, b) Important, and c) Not-so-Important. This exactly allows us to understand the importance of the products. and this categorization also help us to evaluate the amount we have to spent on a category in a single month.

It may be this way possible…..

| Most Important Daily Meal Rents Services | Important Travel Comfort Learning | Not-so-Important Eating Outs Shopping Every time Entertainment |

We might think of this as the last century trick, trust me this is what only works. It will not only save your money but also time while even on the go. Categorization is something very important, especially, we become focused and targeted. Also, once we began understanding the gap in between important and not so important things, then we actually start maneuvering our money in the smartest way possible.

4. Spent Less on regular Rough Products

We always think that the more branded product we will have, the more reputed we will be in our society. Psychologically, we are actually trying to connect our identity to the brand identity that would further create, enhance, and showcase our better life to the community we are living in or we wish for.

But the truth is something else, and that lies in the expenditure we make every month to profit these international brands. We never know that our favorite brand is using cheaper product to charge us so much extra that we cannot even imagine. So, we must make some financial principles for ourselves and work on them with commitment.

Principles Matters

One of the principles must be that we must spend less on the products that are about to be used on the regular basis. Like T-Shirts for regular use, regular rough and tough watch, and so on. Once we start spending less on the products that are really not so essential to us, basically we save more money for our well-groomed branded products. And this way we are clearing a path to have big branded products to put on the occasions.

5. Take Savings into Investments

we must start investing from the early age possible. This would not only secure our future, but also ensures our comfortability in our life. Just feel how people remain calm and confident when they realize that they have a sufficient amount of money to support them.

In fact, in some cases and in some countries, there is a tendency to start investing and saving for their retirement, and that is even at the very early age that may be around 14-16 years. So, investment is something we can never miss, and if we do so then it will feel us as we have missed the lifetime opportunity.

The point is that we must take our saving as our expenditures, and think that we must save to secure our only better future. And we must start investing as soon as possible. Now a days things have been so much improved; we had never thought of that. Now people have no longer to go to the bank, every baking function could be done online. And that is also with just a snap of the finger. So, a little research and reading can make us a smart investor at least for ourselves.

Nothing holds us back

The entire world has become so smarter than never before. This has only become possible with the flow of information throughout the globe. But this exponential flow of information has also made people worldwide, financially sound which has come with most advanced financial knowledge that now people can have on their fingertips.

So, why cannot we get into this? And specially what’s holding us back? Today we can make and save so much of money that was never possible before. Thus, this is the opportunity of the century, a bonanza offer that would never come again, at least we must think such way.

No stone keeper is going to turn us saying ‘wake up’. No one is going to bother how much efforts we make to let little things happen. There is no one in the world who is holding us back from saving our own tiny chunk of future. So, just save more, and invest even more.

Saving that extra penny of future depends upon spending that extra penny of past.

Unknown